Table of Contents

The short answer is no. There is no free life insurance for 100% disabled Veterans. Not anymore at least.

There used to be a VA backed policy for free life insurance for 100% disabled Veterans called “S-DVI” or Service-Disabled Veterans Life Insurance up until December 31, 2022. Unfortunately, this program got discontinued when the VA launched their new “VA Life Insurance” program and as of right now there is no free life insurance for 100% disabled Veterans – or any rating for that matter. There are however a lot of very affordable life insurance programs for all Veterans that extend coverage also to disabled Veterans. If you already have free life insurance for 100% disabled Veterans you can keep the policy as is, you don’t have to do anything.

Are all S-DVI policies free for disabled Veterans?

No, only those Veterans who are totally disabled (100%) were able to receive a waiver for the premium on their policy. For everyone else the premium depends on their age, amount of insurance, coverage plan and whether your billing is set to monthly or annually as the VA gives a slight discount to all annual billings.

What are your options for life insurance as a disabled Veteran?

Now that you can’t get free life insurance for 100% disabled Veterans, it depends on a few factors. The main deciding factors are your age and health. The younger and in better health you are, the better of a deal you’ll get. So go get as many quotes as possible. There is no better day than today. Only yesterday would have been better. Generally speaking, you would want insurance for your “working years” so about until retirement.

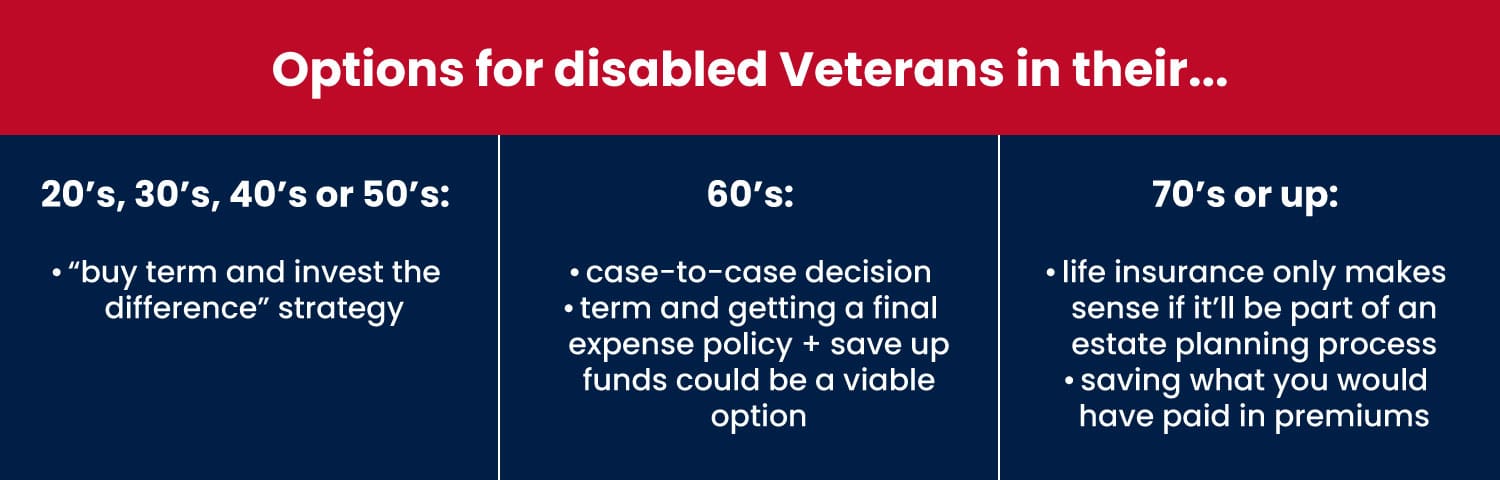

If you’re in your 20’s, 30’s, 40’s or 50’s you want to go with the “buy term and invest the difference” strategy. What’s the difference? The difference in premium when you think about whether you want to go with term or whole life insurance. We explain this here in this article.

If you’re in your 60’s, it’s more of a case-to-case decision on what’s best for you. Both term and getting a final expense policy + save up funds could be a viable option. You can contact one of our life insurance partners here to get a personalized consultation on what options you have and what the best approach would be.

If you’re in your 70’s or up, life insurance does not really make sense for you unless it’ll be part of an estate planning process. You’re far better off simply saving what you would have paid in premiums in a HYSA (high yield savings account) or within low-risk mutual funds or government bonds.

But I am a disabled Veteran won’t all the life insurance disapprove my application?

We’ve heard that a lot and we’re not sure where this myth comes from, but most insurers do insure disabled Veterans. It of course depends a bit on your actual medical status, however most disabilities do not compromise eligibility for a life insurance policy – even if you’re rated at a 100%. In addition to that, Veterans with PTSD can also get a term life insurance generally speaking and yes, coverage does include suicide. Sometimes you just have to get a few more quotes. We’re happy to help you with that and please let us know if you need assistance.