We are privately owned and not affiliated or endorsed by any government agency.

We are privately owned and not affiliated or endorsed by any government agency.

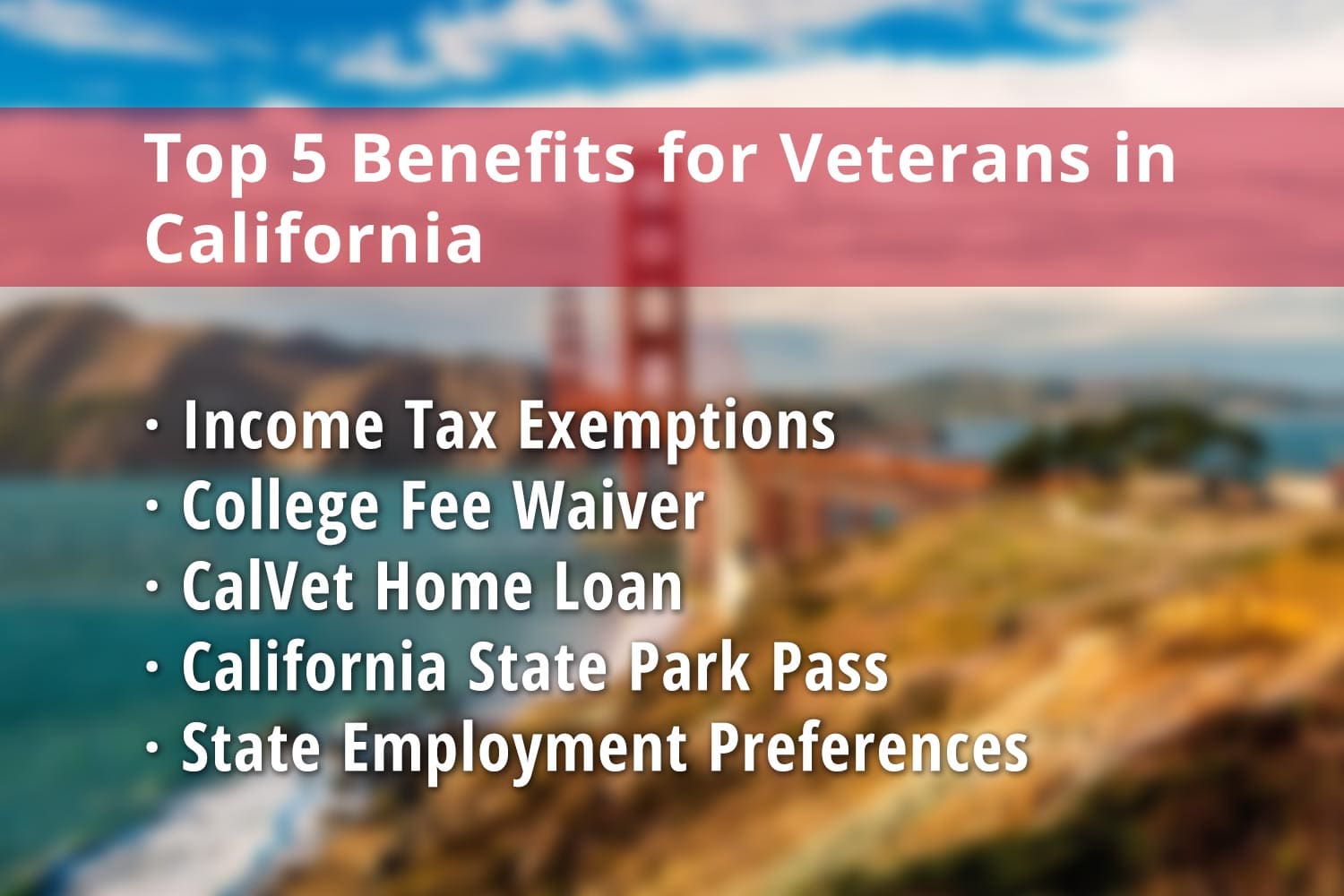

CalVet Home Loan, Veterans Income Tax Exemptions, California State Park Pass and more

Many who join the military enjoy the multitude of federal benefits awarded to them for their service through the Veterans Administration (VA), such as the GI Bill education and TRICARE health benefits. However, many are not aware that many states also offer their own in-state benefits to their residents who have served in the Armed Forces. The state of California has many state-level benefits for Veterans, Servicemembers and retirees residing within the state. Administered through the California Veterans system, anyone who has served in the military and resides in California can access their state benefits through this program. Some California Veteran benefits include such perks as a CalVet home loan with low interest rates, a California state park pass, a California Veteran driver’s license, Veteran income tax exemptions, California hunting license, and special CA Disabled Veteran license plate programs. Learn more below.

At the federal level, there are many financial benefits for Veterans and Servicemembers, and California also offers financial perks as part of its California Veteran benefits programs, many of which work jointly with federal programs.

California aims to make financial struggles easier for Veterans through its CA property tax exemption for Veterans program. California offers two programs for property tax, one for disabled Veterans and one for non-disabled Veterans. For the Veterans exemption, one must be considered a Veteran by the VA; that is to say, they served active duty, were discharged honorably, or were called into action from the National Guard or Reserves for at least 90 days. To claim the exemption as a disabled Veteran, the applicant must have a disability rating from the VA. Both programs require the applicant to reside at the property they are claiming as their primary residence and to be a resident of California. These exemptions also partner with the CalVet home loan program.

California also offers a Veterans income tax exemption for Servicemembers as part of its California Veterans benefits program. California offers several income tax exemptions for Veterans, including military retirement income, survivor benefits, and disability exemptions. For example, California does not tax military income, thus giving Veterans income tax exemptions in this way. Disabled Veterans qualify for even further income tax exemptions on civilian pay, and spouses of those who died in the line of duty also qualify for certain Veteran income tax exemptions. Not all Veterans income tax benefits apply, however.

Veterans residing in California with a disability rating from the VA qualify for a specialized CA disabled Veteran license plate, identifying them as disabled Veterans, with access to special parking and other automobile privileges. To qualify for this license plate, one or more of the following must apply:

Learn more about this program at this link.

The state of California also offers to Veterans a specific California Veteran drivers license identifying them as Servicemembers. Eligible applicants receive a state-issued driver’s license with the word “Veteran” on the front, allowing them to take advantage of various programs for Veterans offered by the state, but also by private entities that offer specials to Servicemembers, such as Lowe’s and Kohls. It does not, however, replace the standard-issue military ID.

Many join the military for the educational opportunities available through the various forms of the GI Bill. However, in addition to this, the state of California also offers its own educational benefits as part of its California Veteran benefits programs. Veterans have many educational perks to enjoy, such as a California college fee waiver on tuition at many in-state universities and colleges and various other supplemental programs that work alongside the GI Bill. CalVet also assists Veterans in applying their federal benefits alongside their California Veteran benefits when pursuing a higher education or specialized training.

Many of the California Veteran benefits awarded to Servicemembers residing in the state include employment benefits. California offers state employment preferences to Veterans when hiring for state and local government positions. California also offers Veterans business assistance programs to vet-owned businesses within the state.

Employers rank applicants and their spouses who pass the state civil service test higher in the selection lists. However, the preference ends once an individual receives a civil service appointment. To qualify for employment selection preference, one must have served in the US Armed Forces in active duty, with an honorable discharge, or be within six months of separation from the military. Spouses must be married to an eligible Veteran, or the spouse of a 100% disabled Veteran. Learn more at this link.

California also offers benefits to Veteran owned businesses. Some of these include waived business license fees, business tax waivers, employee military leave and state leave benefits, and incentives for businesses that hire Veterans.

For disabled Veterans, there are specific 100% disabled Veteran benefits California programs, aiding them in searching for jobs. The Employment Development Department offers job search assistance, job fairs, and employer recruitments. The America’s Job Centers of California offer job training, vocational education, and supportive services.

While the VA offers an inclusive healthcare system for military personnel, California, as part of its California Veteran Benefits, also facilitates medical and mental health options for Veterans within the state. The Fresno CA Veterans Hospital is one of the largest in the country and administers 100% disabled Veteran benefits California programs statewide.

While the VA offers its own healthcare system, primarily the TRICARE system for service members, California also offers its own in-state health and medical programs. The California National Guard Surviving Spouses and Children Relief Act authorizes the payment of $10,000 in death benefits to surviving spouses or beneficiaries of California National Guard Servicemembers killed in a line of duty. California also offers the California National Compensation for injury, illness, disability, and death incurred while on state active duty for National Guard Servicemembers who are injured, become ill or disabled, or die in the line of duty serving the state. For disabled Veterans in need of medical transportation, the Disabled American Veterans provide transportation services to California Veteran healthcare facilities.

One of the most important things for military families is finding a place to call home, especially in later years. To assist in this, California Veterans benefits programs offer a variety of options for military personnel, in conjunction with federal programs such as VA-backed home loans.

For Veterans in need of skilled nursing care or assisted living, there are options for residence in California State Veterans Homes. As a part of the CA state Veterans benefits program, CalVet works alongside the VA to administer the Veterans Home Yountville facility, which accommodates over 800 residents, Veterans and their families. The facility offers onsite therapeutic treatments, medication monitoring, skilled nursing care, dining facilities, dentistry and outpatient care, and onsite emergency medical assistance. This CalVet facility accommodates Veterans in all stages of aging, ranging from independent living to assisted living to memory care.

The state offers the CalVet Home Loan Program, as part of its CA state Veterans benefits, in which qualifying Veterans may apply for home loans that have low rates, low fees, no down payments, and flexible terms. These loans often go hand in hand with the CA property tax exemption for Veterans as well.

The state of California is larger than some European countries and boasts a wide variety of outdoor wonders to enjoy, ranging from deserts and beaches to woodlands and mountains. Veterans can enjoy the California State Park Pass as well as hunting and fishing licenses under certain conditions.

The California State Park Pass for Veterans is available through its Distinguished Veteran Pass. To be eligible, a Veteran must have a disability rating of 60% or higher, be a Medal of Honor recipient, or be a former prisoner of war.

The state also offers a specialized California hunting license for those who enjoy hunting and fishing. The state offers a disabled Veteran hunting and fishing license, as well as a recovering Servicemember license. These licenses are available at a reduced rate, 50% less than regular licenses.

When the time comes for a Veteran’s final rest, California offers several options in the way of military cemeteries. The Riverside Veterans Cemetery California is one option, as well as the Yountville Veterans Home Cemetery and the Yurok Veterans Cemetery, among many others. To be eligible for internment in these cemeteries, one must have served in active duty, died while on duty, served 20 years in the National Guard, or was activated Reserve during wartime. All require an honorable discharge. Read more about CalVet cemeteries at this link.

Brave Veteran is not approved or endorsed by the U.S. Federal Government, the Department of Defense, any military branch, or any government agency. The products, services, and information offered on Brave Veteran are independent and not provided by any government entity. Brave Veteran is supported by advertising, and we may receive compensation from companies whose offers appear on this site.

© 2025 braveveteran.com All Rights Reserved