We are privately owned and not affiliated or endorsed by any government agency.

We are privately owned and not affiliated or endorsed by any government agency.

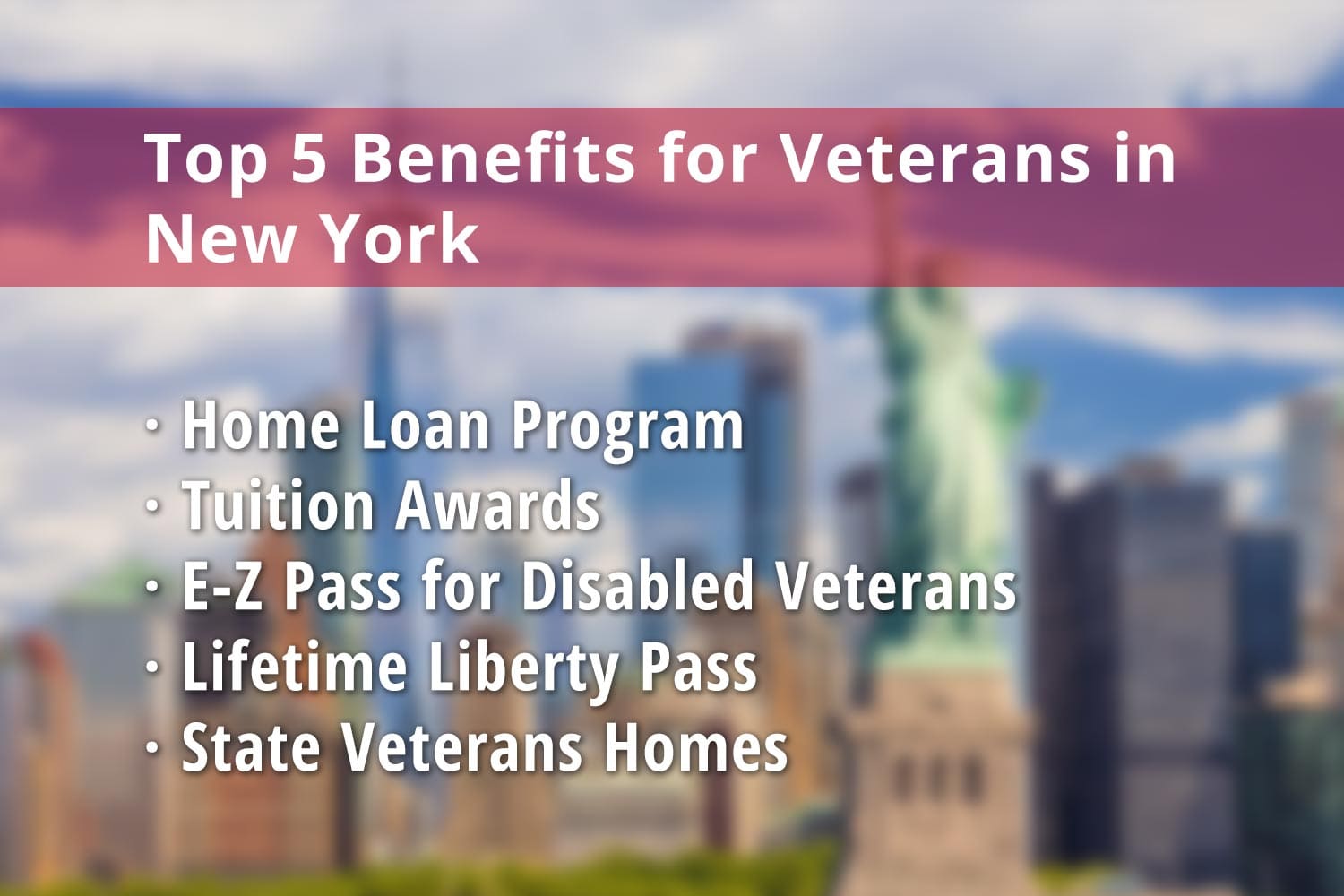

Home Loan Program, E-Z Pass for Disabled Veterans, Lifetime Liberty Pass and more

The state of New York makes a concentrated effort to support its military and Veteran residents. While Veterans, Servicemembers and retirees have access to many federal-level benefits, often states must offer their own support of Veterans to assist their military residents with accessing these federal benefits or perhaps filling in any gaps to service and support from federal benefits. New York state Veteran benefits include such programs as the New York state property tax exemption for Veterans, the New York income tax exemption for Veterans, special license plates for designated Veterans, and the New York hunting license for Veterans, among many others. Keep reading to learn more about New York state Veteran benefits.

Former Servicemembers residing in New York have many New York state Veteran benefits available to them, including the New York state property tax exemption for Veterans and the New York income tax exemption for Veterans, especially disabled Veterans.

Veterans have the opportunity to apply for property tax exemption under New York law and as part of the New York State Veterans benefits programs, assuming they meet certain eligibility requirements. The Real Property Tax Law, section 458, outlines the various circumstances in which a Veteran might receive a partial exemption under one of the three programs, the New York Alternative Veterans Property Tax Exemption, the New York Cold War Veterans Property Tax Exemption or the Eligible Funds Veterans Exemption. Veterans qualify for the alternative exemption, which is 15% of the property value, if they have a service-connected disability.

Some military pay and benefits are generally exempt from New York State income tax. The New York State income tax exemption for Veterans includes military retirement pay, whether the Servicemember is active duty or not. However, general military pay is indeed subject to New York income taxes. The New York Military Spouse Residency Relief Act is a program in which the spouse of a Servicemember stationed in New York state, but is not themselves a resident, is exempt from New York income taxes on salaries earned while living in New York under military orders.

Some states offer E-Z Pass programs that provide free or discounted toll travel for disabled Veterans, often requiring a fee-exempt vehicle registration or meeting specific disability criteria. The New York State Thruway Authority offers free, unlimited travel to certain qualifying disabled Veterans with a fee-exempt vehicle registration from the New York State Department of Motor Vehicles and free tollway travel.

Most people are familiar with the GI Bill, which provides tuition assistance and educational benefits at a federal level. However, many states, including New York, also offer state-level assistance to Veterans and Servicemembers pursuing an education. NY Veterans are eligible for the NY State Veterans Tuition Awards, which can be used in conjunction with the GI Bill. There is also a Military Residency Waiver for those stationed in New York from out of state, which waives out-of-state tuition and fees for those seeking an education while residing in New York if on active duty. There is also the Rainbow Division Veterans Foundation Scholarship Program, which awards undergraduate scholarships to soldiers assigned to the 42nd Infantry Division and descendants of RDVF members. Scholarship amounts have ranged from $500 to $5,000, depending on available funds.

As part of the New York State Veterans benefits, the New York State Recruitment Incentive and Retention Program is a state initiative for New York National Guard military personnel that will cover tuition for the State University of New York tuition rate. You can use it for up to eight semesters of full-time study or 16 semesters of part-time study. The maximum award that service personnel can receive is $1,700 every semester or $3,400 each year. To be eligible:

The Military Enhanced Recognition Incentive and Tribute (MERIT) Scholarship provides financial assistance to families and financial dependents of Servicemembers or state-organized militia who became permanently disabled or died while performing military duties in New York State.

As part of its extensive New York State Veteran benefits, NY offers many employment perks for Veterans living within its borders including free job help at many of its state career centers. Aside from the number of jobs for Veterans in New York, there are various other employment benefits for Veterans, including hiring preferences, job retention rights, and access to specialized programs like the Veterans with Disabilities Employment Program. The state also has the Service-Disabled Veteran-Owned Business program, which is run by the NYS Office of General Services. The goal of this program is to get more certified Veteran businesses to work on state contracts, with a target of 6% of all procurement spending. New York also offers paid family leave for military duty, re-employment rights for Servicemembers that protect placement in civilian jobs, and protections for those who must be deployed to return to work without penalty, loss of seniority, or compensation.

Anyone looking for jobs for Veterans in New York will have a certain preference for civil service jobs. When hiring and promoting state employees, the state gives preference to Veterans. Veterans with disability ratings receive ten points of extra credit for open position exams and five points for promotion consideration. To qualify for this preference, applicants must be New York residents who served active duty, received an honorable or medical discharge, and have a service connected disability rating of 10% or above.

The NYS SDVOB program is a state-regulated initiative designed to promote the inclusion of service-disabled Veteran-owned businesses in New York State’s economy by increasing their participation in state contracting opportunities. To become certified as an SDVOB, businesses must meet specific eligibility requirements, including being at least 51% owned and controlled by one or more service-disabled Veterans with a 10% disability rating or higher.

New York Veterans can access a range of health insurance benefits, including VA health care, CHAMPVA for eligible dependents, and potentially TRICARE, depending on their service status and eligibility. Servicemembers and Veterans may access healthcare at a variety of VA clinics and hospitals, including the New York City Veterans Hospital. Some state-specific healthcare programs exist in the form of New York State benefits for 100% disabled Veterans as part of the general NY Veterans benefits program as well.

New York State offers its activated National Guard members a medical compensation and coverage program for any illness or injury sustained while on active duty, in addition to the resources offered by the VA TRICARE system. Veterans in the New York area also have access to the VA NY Harbor Healthcare System. The VA New York Harbor Healthcare System is a part of the Veterans Health Administration that provides healthcare services to Veterans in the New York and New Jersey area, including medical centers, clinics, mobile clinics, primary care, mental health care, rehabilitation, and extended care.

New York offers several Veteran home benefits, including property tax exemptions, assistance with down payments through the “Homes for Veterans” program, free or reduced-cost Thruway travel for disabled Veterans, and the Veterans Emergency Housing Program for short-term assistance, as part of its New York State Veteran benefits program. Veterans may obtain a property tax exemption on their primary residential property, as well as short-term financial assistance of up to $2,000 a year to help with qualifying emergency housing needs.

In partnership with the VA, the state Department of Veterans Affairs maintains several New York State Veterans Homes to provide skilled nursing care and assisted living services to New York Veterans. These New York state Veterans homes provide care with no out-of-pocket costs to the resident and range from independent living to full-scale skilled nursing care and memory care. Veterans with a 70% or greater service-connected disability and a skilled nursing need are entitled to no-cost nursing home care at any State Veterans Home, with services paid for by the VA.

This Veteran home loan program New York benefit allows qualifying Veterans to secure a home loan through the following:

New York State provides Veterans and Gold Star families with free or discounted access to state parks, campgrounds, recreational facilities and historical sites through its Veterans park pass program.

The New York State Veteran Benefits program offers a special New York State Park Pass for Veterans. The Lifetime Liberty Pass includes the following benefits:

New York resident Veterans with a 40% or greater service-related disability are eligible for reduced-fee hunting and fishing licenses, with a cost of $5 for one license, and the other two licenses are free. This New York hunting license for Veterans is available at DEC regional offices.

As part of the NY Veteran benefits system, the state also operates several Veteran cemeteries and the New York Vietnam Veterans Memorial Plaza Square. Veterans who served active duty with an honorable discharge and their spouses are eligible for burial in any of the New York Veterans cemeteries. All applicants must also be New York residents at the time of death.

New York is a state that makes an effort to honor its Veterans through many state-level benefits and perks. The Veteran home loan program New York benefit, the New York state park pass for Veterans and the VA NY Harbor Healthcare system are just some of the benefits Veterans can receive.

Brave Veteran is not approved or endorsed by the U.S. Federal Government, the Department of Defense, any military branch, or any government agency. The products, services, and information offered on Brave Veteran are independent and not provided by any government entity. Brave Veteran is supported by advertising, and we may receive compensation from companies whose offers appear on this site.

© 2025 braveveteran.com All Rights Reserved