We are privately owned and not affiliated or endorsed by any government agency.

We are privately owned and not affiliated or endorsed by any government agency.

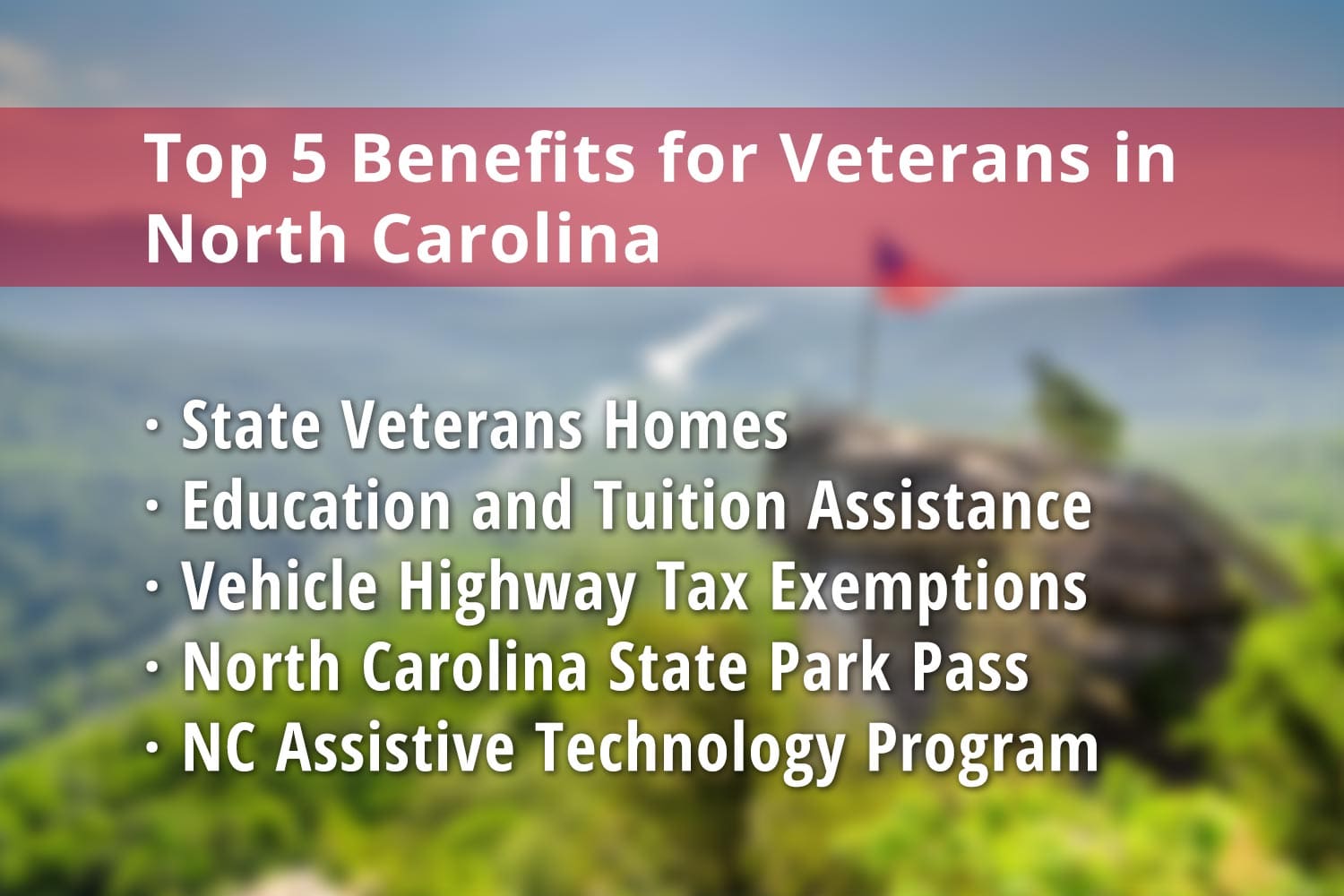

State Veterans Homes, Tax Exemption for Veterans, North Carolina State Park Pass and more

North Carolina is one state that has a multitude of military operations within its borders, and as a result, many in-state residents are Servicemembers and Veterans. North Carolina has multiple military installations, including Fort Liberty (formerly Fort Bragg), Marine Corps Base Camp Lejeune, Marine Corps Air Station Cherry Point, and Marine Corps Air Station New River, among others. The state offers Veterans numerous state-level benefits, including property tax exemptions for disabled Veterans, state employment preferences, discounted hunting and fishing licenses, and in-state tuition for Veterans and their dependents. North Carolina Veterans have access to such perks as the North Carolina property tax exemption for Veterans and the North Carolina hunting license for Veterans, for example. Read on to learn more.

The state of North Carolina has many state-level financial benefits that work in conjunction with federal financial programs for Veterans. Some of these state-specific North Carolina Veteran benefits include the North Carolina property tax exemptions for Veterans, state employment preferences, vehicle registration benefits, and the North Carolina income tax exemption for Veterans, among others.

Several North Carolina Veteran benefits include some form of property tax exemption, especially for disabled Veterans, meaning that some Veterans might qualify for more than one program. (ex: Both military and senior citizen exemptions) Disabled Veterans may exclude up to $45,000 of their permanent residence’s appraised value, so long as it is occupied by the owner. To qualify, you must have a 100% disability rating due to a service-connected disability, as well as an honorable discharge.

North Carolina Veterans also enjoy income tax exemptions under certain circumstances. While regular military pay is still taxed, combat pay or hazardous duty pay is exempt. Retired military pay is also exempt, as is any disability pension. Servicemembers also have a 180-day extension to file their state taxes. For the survivors of Veterans who died while on duty, there are the North Carolina Tax Deduction for Military Survivor Benefit Plan, Reserve Component Survivor Benefit Plan, and Retired Serviceman’s Family Protection Plan Annuities, which allow certain deductions from the spouse’s salary.

In North Carolina, vehicles owned by Veterans with a 100% disability rating, as determined by the VA, are exempt from local motor vehicle taxes. The NC Office of Motor Vehicles also provides several specialized license plates to Veterans and Servicemembers who meet certain conditions. The plates are free to qualifying applicants, such as Purple Heart recipients, disabled Veterans, and Gold Star families. The state also provides Veteran drivers licenses and ID cards to honorably discharged North Carolina residents who are Veterans.

North Carolina offers various education benefits for Veterans, including the North Carolina Scholarship for Children of Wartime Veterans, the Yellow Ribbon program, and state tuition assistance that work alongside federal programs like the GI Bill.

Many Veteran education benefits in North Carolina focus on supplementing the GI Bill and filling in gaps where federal tuition assistance does not cover certain situations. Consider some of the following programs:

North Carolina Vietnam Veterans Incorporated Scholarship Program:

Provides scholarships to Vietnam Veterans and their descendants for undergraduate study at approved institutions.

North Carolina Yellow Ribbon Program:

This program helps cover tuition costs not covered by the GI Bill, particularly for in-state tuition at UNC System colleges for Veterans who are eligible for the Post-9/11 GI Bill.

North Carolina National Guard Tuition Assistance Program:

The program provides tuition reimbursement for drilling members of the North Carolina National Guard who are attending approved North Carolina educational institutions.

Military Residency:

In certain cases, Veterans and their families may be eligible for in-state tuition rates, regardless of residency status and requirements.

This scholarship, part of North Carolina Veteran benefits, covers four years of tuition at an approved North Carolina university, college, or technical school for eligible children of Veterans who served during active military engagements. It covers eight semesters and must be used within eight years. To be eligible, the student must be the child, stepchild, or adopted child of a Veteran killed in action, disabled, or POW, and must be 25 and under at the time of application. The Veteran must be a resident of North Carolina, and the child must have been born in North Carolina and in continuous residency since birth, although this might be waived under some circumstances.

There are several Veteran employment benefits in North Carolina aimed at assisting those exiting the military in transitioning into civilian jobs. North Carolina offers Veterans several employment benefits, including a state employment preference, priority access to job applications and career advisors, and potential tax breaks for employers who hire Veterans. The state also provides NCWorks Veterans services, which provide Veterans with career services and priority access to job applications.

For Veterans applying for state jobs in North Carolina, as part of the NC Veteran Benefits Initiative, former military members get priority during the hiring process with regards to state government jobs. This includes extra points given on qualifying civil service exams and time spent in the military as a result of past experience in certain jobs. These extra points allotted to Veterans also apply to promotions and reassignments.

North Carolina Veteran benefits programs provide NCATP as a state and federally funded program designed to provide services to disabled people of all walks of life residing in North Carolina, but especially to disabled Veterans. NCATP offers short-term loans of assistive devices and technology to individuals in need, along with training on their use. This includes sensory aids, vision impairment assistive devices, and mobility devices.

North Carolina Veteran benefits extend to healthcare services, which work in conjunction with the VA healthcare system to provide primary and emergency healthcare to Veterans in North Carolina. This includes the VA Hospital North Carolina system and other North Carolina benefits for 100% disabled Veterans. The federal VA healthcare system provides the majority of healthcare, but the state offers supplemental services to members of the National Guard.

Active members of the NC National Guard are eligible for the NC State health plan typically provided for teachers and state employees, in addition to any VA health benefits for which they qualify. Any members who become ill, die, or disabled while serving in the National Guard also qualify for specialized medical coverage under the North Carolina Workers’ Compensation Act.

North Carolina offers Veterans various home-related benefits, including property tax exemptions for disabled Veterans, access to state-operated Veterans’ homes, and down payment assistance through the NC 1st Home Advantage Program. For home-related North Carolina Veteran benefits, there is the homestead exemption of up to $45,000 of a home’s value, so long as it is the inhabited primary residence of qualifying Veterans. Other home-centric NC Veterans benefits include property exemptions for 100% disabled Veterans and Veterans over the age of 65.

There are four Veterans homes in North Carolina, operated by the state in conjunction with the Veterans Administration, which provides independent living, assisted living, skilled nursing care, and memory care for qualifying Veterans. These homes offer private rooms, 24-hour nursing, IV therapy, oxygen therapy, physical therapy, occupational therapy, speech therapy, wound care, pain management, counseling services, family support groups, laundry, volunteer services, and other services.

Some of the more coveted of the North Carolina Veteran benefits are the North Carolina hunting license for Veterans and the North Carolina State Park pass for Veterans. North Carolina Veterans can enjoy various parks and recreation benefits, including discounted or free admission to state parks and attractions and a free lifetime pass to national parks and other federal recreational lands.

Veterans, and most active-duty Servicemembers, qualify for free or discounted admission to various North Carolina state parks. Disabled Veterans are eligible to receive free passes and other discounts at state attractions. Eligible Veterans also receive a $6 discount on state park campgrounds.

North Carolina provides a free, lifetime hunting and fishing license for Veterans with a 50% disability rating or higher. Purple Heart recipients and Medal of Honor recipients also qualify for this free lifetime license.

North Carolina has both national and state Veteran cemeteries, including New Bern, Raleigh, Salisbury, and Wilmington National Cemeteries, and Coastal Carolina and Western Carolina State Veterans Cemeteries. To be eligible for burial in these cemeteries, an applicant must have served in the US Armed Forces with an honorable discharge, be a resident of North Carolina at the time of death, and have served in active duty or under military call-up orders if they were part of the National Guard or Reserve component. Spouses and widows are also eligible for burial. Veterans cemeteries in North Carolina provide interment for both casket and cremated burials as part of the North Carolina Veteran benefits program.

Veterans in North Carolina are fortunate to reside in a state that offers so many benefits to its resident Servicemembers. Benefits such as the North Carolina income tax exemption for Veterans, educational and career assistance, and other useful benefits are all ways in which North Carolina shows its appreciation to those who served.

Brave Veteran is not approved or endorsed by the U.S. Federal Government, the Department of Defense, any military branch, or any government agency. The products, services, and information offered on Brave Veteran are independent and not provided by any government entity. Brave Veteran is supported by advertising, and we may receive compensation from companies whose offers appear on this site.

© 2025 braveveteran.com All Rights Reserved