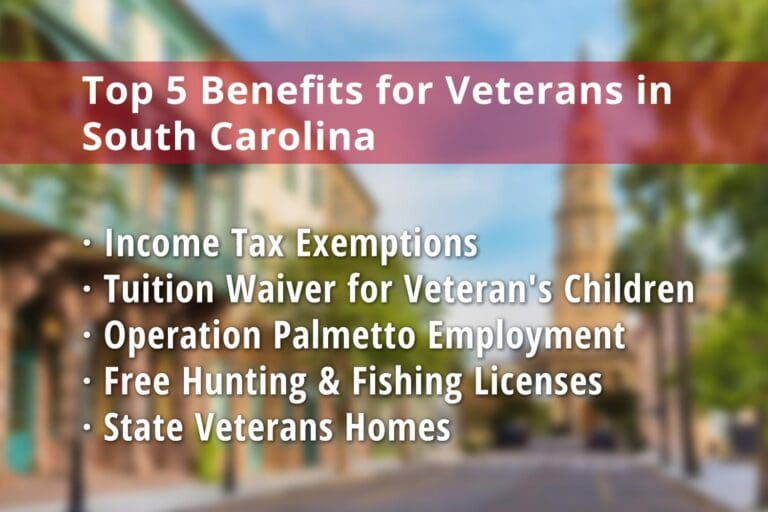

South Carolina Veteran Benefits

Tuition Waiver, Disabled Veterans Benefits, South Carolina Hunting License and more South Carolina is a state that honors its Veterans through a variety of supportive programs and opportunities. Some of these benefits include tax exemptions, employment preferences, educational assistance, and access to state services and resources. There are also opportunities through South Carolina Veteran benefits programs for the SC VA tuition waiver, the SC tax exemptions for disabled Veterans, and a special South Carolina hunting license for Veterans. The Veterans Administration Columbia South Carolina Office also works in conjunction with state-level Veterans services to bring these benefits to South Carolina Veterans and Servicemembers. South Carolina Veteran Financial Benefits South Carolina offers various financial benefits to Veterans, including property tax exemptions, income tax deductions for military retirement pay, state employment preference, and free hunting and fishing licenses for disabled Veterans, as well as tuition assistance for certain war Veterans’ children. Some South Carolina Veterans benefits include the SC tax exemption for disabled Veterans, as well as the South Carolina disabled Veteran property tax exemption. Disabled Veteran Property Tax Exemption Veterans who have a total and/or permanent service-connected disability qualify for several disabled Veterans benefits in South Carolina, including

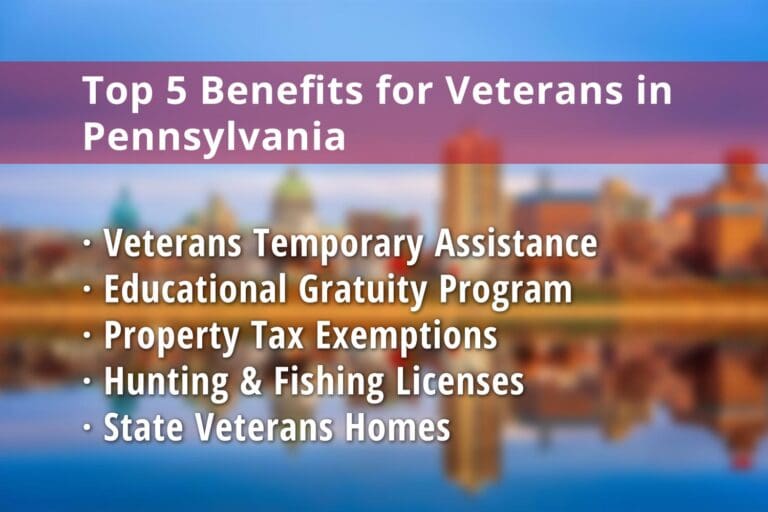

Pennsylvania Veteran Benefits

Pennsylvania Soldiers and Sailors Home, Tax Exemptions for Veterans, Veteran Fishing License and more Pennsylvania is a historic state with many contributions to American history, and the state is quite proud of its military heritage going all the way back to the Revolutionary War, when militiamen guarded Philadelphia as the Declaration of Independence was signed. Today, the state has a rich modern military system that, while not as extensive as other states, still proudly provides military installations such as Fort Indiantown Gap, the Carlisle Barracks, and many programs of support for its resident Veterans. Pennsylvania offers Veterans a range of benefits, including financial assistance, educational opportunities, and tax exemptions, as well as specialized programs for disabled Veterans and their families. Some of these Pennsylvania Veterans benefits include specific Pennsylvania disabled Veteran benefits, the PA Veteran property tax exemption, the PA Veterans income tax exemption and the Pennsylvania State Park Pass for Veterans, among others. Read on to learn more. Pennsylvania Veteran Financial Benefits Pennsylvania provides several financial benefits to Veterans, including emergency assistance for necessities, educational gratuity, real estate tax exemptions, and pensions for blind and paralyzed Veterans, among other Pennsylvania Veteran benefits. Property Tax Exemption for

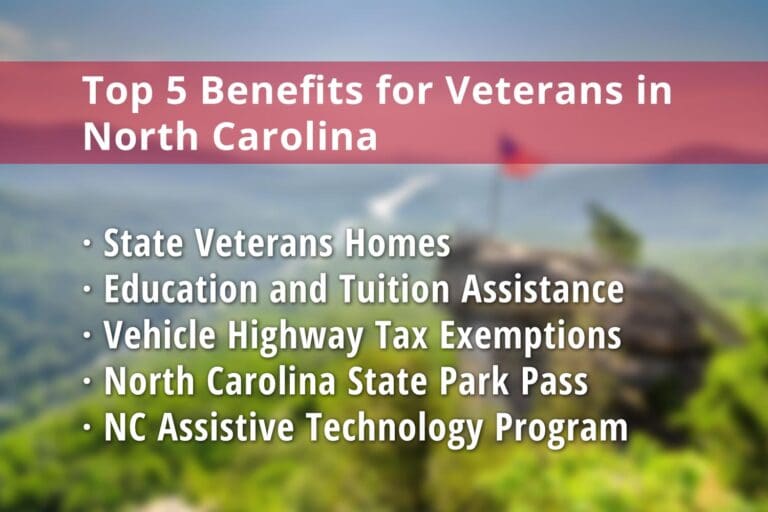

North Carolina Veteran Benefits

State Veterans Homes, Tax Exemption for Veterans, North Carolina State Park Pass and more North Carolina is one state that has a multitude of military operations within its borders, and as a result, many in-state residents are Servicemembers and Veterans. North Carolina has multiple military installations, including Fort Liberty (formerly Fort Bragg), Marine Corps Base Camp Lejeune, Marine Corps Air Station Cherry Point, and Marine Corps Air Station New River, among others. The state offers Veterans numerous state-level benefits, including property tax exemptions for disabled Veterans, state employment preferences, discounted hunting and fishing licenses, and in-state tuition for Veterans and their dependents. North Carolina Veterans have access to such perks as the North Carolina property tax exemption for Veterans and the North Carolina hunting license for Veterans, for example. Read on to learn more. North Carolina Veteran Financial Benefits The state of North Carolina has many state-level financial benefits that work in conjunction with federal financial programs for Veterans. Some of these state-specific North Carolina Veteran benefits include the North Carolina property tax exemptions for Veterans, state employment preferences, vehicle registration benefits, and the North Carolina income tax exemption for Veterans, among others. Property Tax Exemption for

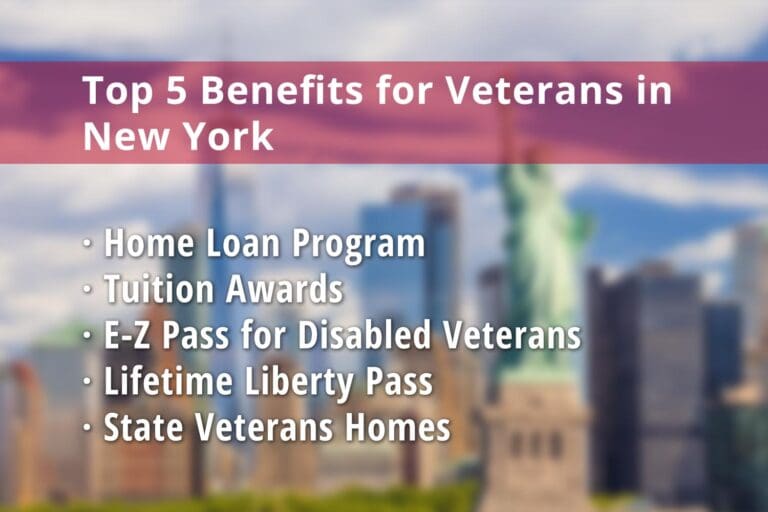

New York State Veteran Benefits

Home Loan Program, E-Z Pass for Disabled Veterans, Lifetime Liberty Pass and more The state of New York makes a concentrated effort to support its military and Veteran residents. While Veterans, Servicemembers and retirees have access to many federal-level benefits, often states must offer their own support of Veterans to assist their military residents with accessing these federal benefits or perhaps filling in any gaps to service and support from federal benefits. New York state Veteran benefits include such programs as the New York state property tax exemption for Veterans, the New York income tax exemption for Veterans, special license plates for designated Veterans, and the New York hunting license for Veterans, among many others. Keep reading to learn more about New York state Veteran benefits. New York Veteran Financial Benefits Former Servicemembers residing in New York have many New York state Veteran benefits available to them, including the New York state property tax exemption for Veterans and the New York income tax exemption for Veterans, especially disabled Veterans. Property Tax Exemption for Veterans Veterans have the opportunity to apply for property tax exemption under New York law and as part of the New York State Veterans

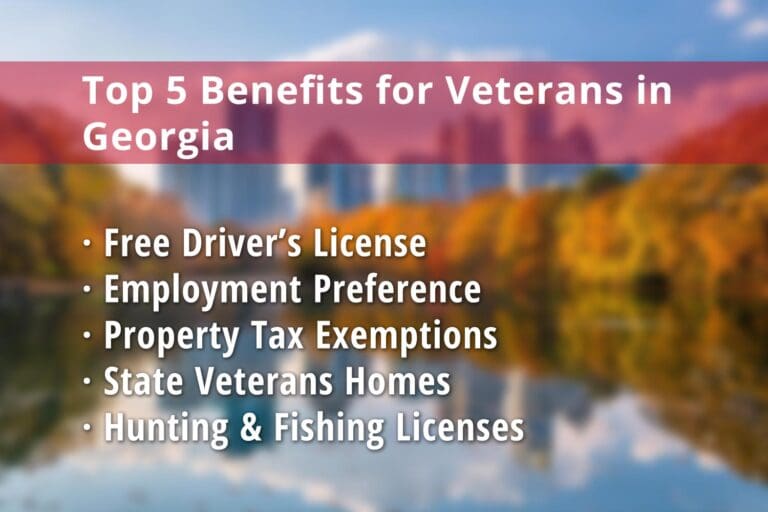

Georgia State Veteran Benefits

State Veterans Homes, Property Tax Exemption for Veterans, Hunting License and more At the federal level, the Department of Veterans Affairs is the authority in providing Veterans, Servicemembers and military retirees with access to their promised benefits for their service. These benefits, which include the GI Bill education benefits, VA-backed loans, and employment assistance, are administered at the national level, but state-level VA programs and state-specific programs are also available for Veterans. Within the state of Georgia, Veteran residents have access to many state-level Georgia state Veteran benefits, as well as other perks. Read on to learn more. Georgia Veteran Financial Benefits In addition to the multitude of financial benefits provided to Veterans at the national level, the state of Georgia also provides its Veteran residents with several Georgia state Veteran benefits. The design of many of these benefits aligns with both the VA and federal benefits. Some financial assistance for Veterans in Georgia are: Property Tax Exemption for Veterans Disabled Veterans may receive a $60,000 exemption from their homestead tax. The Georgia homestead exemption is available to all qualifying Servicemembers residing in the state, although some non-activated Reservists might not qualify for the Georgia homestead exemption

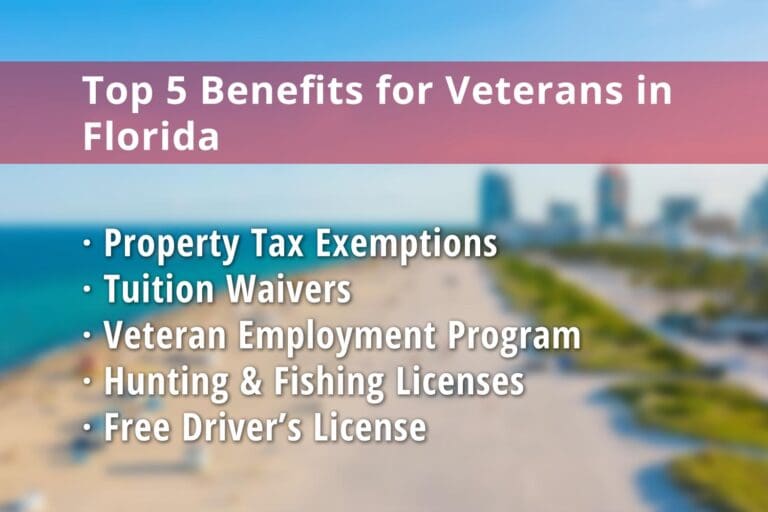

Florida Veteran Benefits

Property Tax Exemption for Veterans, Disabled Veteran Benefits, Free Hunting License and More Florida plays a large role in supporting the United States military, namely through its large network of military installations such as MacDill Air Force Base and Elgin Air Force Base, as well as its support of Servicemembers and Veterans who reside within its borders. The state also supports its resident Veterans through a variety of programs, including a special Florida hunting license, a Florida property tax exemption for Veterans, a special Florida driver’s license for Veterans, and a homestead exemption Veterans program. Keep reading to learn more about how the state of Florida supports its Veterans and Servicemembers with Florida Veteran benefits. Florida Veteran Financial Benefits While the Veterans Administration financial benefits support US Servicemembers nationwide, Florida Veteran benefits work alongside these to provide even more financial relief and perks for its military residents. Florida Property Tax Exemption for Veterans As part of its Florida Veteran benefits, the state offers its Florida property tax exemption for Veterans to Servicemembers with a service-connected disability of 10% or more. This exemption also applies to the surviving spouse of a Veteran who died from service-connected causes. One

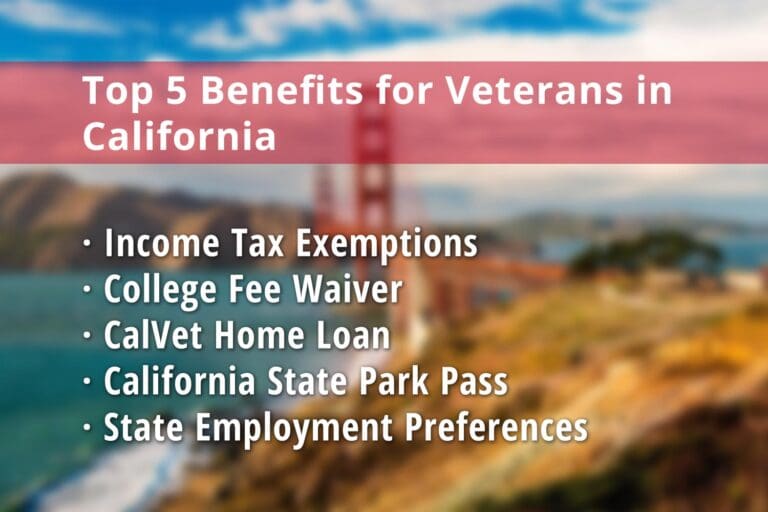

California Veteran Benefits

CalVet Home Loan, Veterans Income Tax Exemptions, California State Park Pass and more Many who join the military enjoy the multitude of federal benefits awarded to them for their service through the Veterans Administration (VA), such as the GI Bill education and TRICARE health benefits. However, many are not aware that many states also offer their own in-state benefits to their residents who have served in the Armed Forces. The state of California has many state-level benefits for Veterans, Servicemembers and retirees residing within the state. Administered through the California Veterans system, anyone who has served in the military and resides in California can access their state benefits through this program. Some California Veteran benefits include such perks as a CalVet home loan with low interest rates, a California state park pass, a California Veteran driver’s license, Veteran income tax exemptions, California hunting license, and special CA Disabled Veteran license plate programs. Learn more below. California Veteran Financial Benefits At the federal level, there are many financial benefits for Veterans and Servicemembers, and California also offers financial perks as part of its California Veteran benefits programs, many of which work jointly with federal programs. CA Property Tax

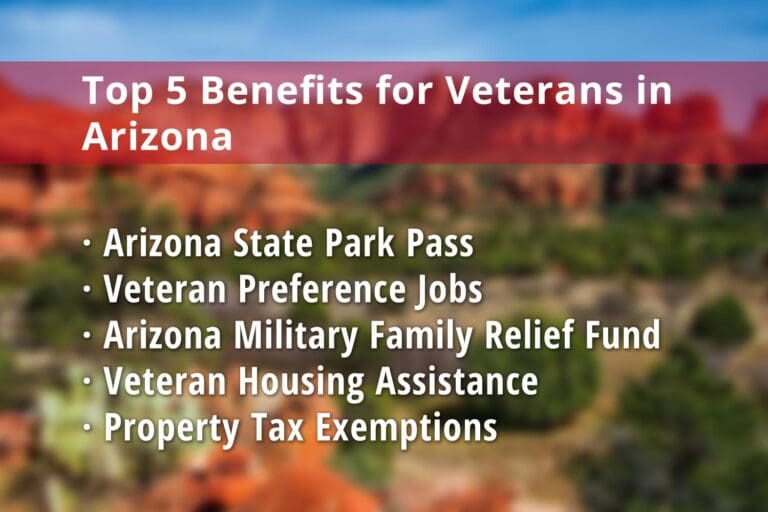

Arizona Veteran Benefits

Arizona Department of Veterans’ Services, Tax Exemption for Veterans, Arizona State Park Pass and more The state of Arizona might not have as much of a history with the military as other states, but it is still a strong contributor to the US Armed Forces and to Servicemembers and Veterans. Arizona has several major military installations, including Davis-Monthan Air Force Base, Fort Huachuca, and Yuma Proving Ground. Those stationed at these bases within Arizona’s borders are fortunate, as Arizona offers a range of benefits to Veterans, including education and training programs, employment assistance, financial exemptions, and access to other benefits. Arizona Veteran benefits also include the Arizona Department of Veterans’ Services, the Arizona property tax exemption for disabled Veterans, the Arizona income tax exemption for Veterans, the Arizona hunting license for Veterans, and the Arizona state park pass for Veterans. There’s even more! Arizona Veteran Financial Benefits Financial concerns often plague members of the military, many of whom might be facing deployment, moving from one posting to the next, or having health concerns. For these reasons, Arizona Veteran benefits programs seek to address these issues with state-level financial programs, many of which work alongside federal benefits. Property

Veteran Benefits Across States: A Guide to State-Specific Resources

Veterans and Servicemembers make many sacrifices to serve in defense of the country, and in return, the country, and individual states, look for ways to give back to them. In addition to federal-level benefits for Veterans, such as VA healthcare and VA education benefits through the GI Bill, many states also provide state-level benefits for Veterans. Some of these include free or reduced recreation passes, Veterans income tax exemptions, drivers licenses, Veterans hospital locations, and state-run Veterans homes. Some states offer certain benefits to Veterans that others do not. For example, Alabama offers tuition waivers to the dependents of disabled Veterans, while Alaska does not. California offers affordable home loans on a state level through CalVet, while other states rely on the VA for VA backed home loans. This article aims to help Veterans navigate these state-specific benefits by providing a comprehensive overview of what each state has to offer. Click on your state in the list below to learn more about Veteran benefits offered in your state. Select Your State Below For Your State-Specific Veteran Benefits: Arizona Veteran Benefits Learn all about the Veteran benefits in Arizona: Arizona Department of Veterans’ Services, Tax Exemptions, Arizona State Park