Table of Contents

Veterans Affairs Life Insurance or “VA Life” Insurance is an insurance policy provided directly through the VA. It’s a whole life insurance policy with the death benefit ranging from $10,000 to $40,000. VA Life Insurance is the VA’s first new life insurance policy in almost 50 years and was established in January 2023. The idea behind it is to help eligible Veterans with service-connected disabilities to gain access to a whole life insurance policy that they can qualify for. At first glance this seems like a good deal, however it’s important to understand why the concept of whole life insurance is disadvantageous for the majority of Veterans – even in old age and/or when they have a service-connected disability. Keep on reading to understand why this is such a bad policy and to understand the difference between VA Life Insurance and VGLI (Veterans Group Life Insurance).

VA Life Insurance (VA Life) is often confused with Veterans Group Life Insurance (VGLI)

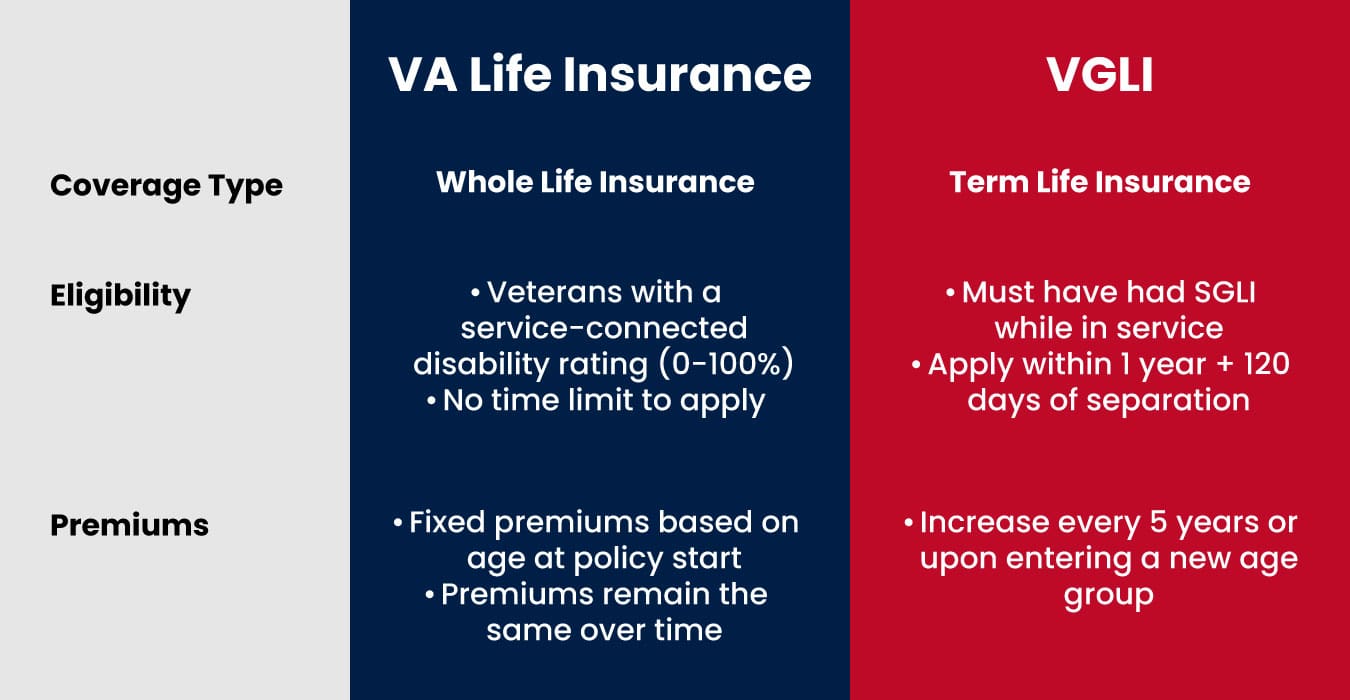

Many Veterans and other people confuse VGLI and VA Life Insurance with one another because of the similar name. However, they couldn’t be more different. One policy, the VA Life Insurance is whole life insurance while the other, VGLI, is a term life insurance. To be fair, VGLI is emulating a whole life insurance with how it’s structured. You can read more on VGLI here and why it’s also a bad deal.

These are the key differences between VA Life Insurance and VGLI:

- Coverage Type: VA Life Insurance is a whole life insurance, while VGLI is term life insurance.

- Eligibility: VGLI is only available to those who had SGLI while in service and applied within 1 year + 120 days of separation. VA Life Insurance on the contrary has no time limit to apply and is designed for Veterans with a service-connected disability not only in mind, but it’s made a requirement. Ratings eligible are from 0-100%.

- Premiums: VGLI premiums increase every 5 years or upon entering a new age group, whereas VA Life Insurance premiums stay the same and depend on your age upon taking the policy out.

Here’s why Whole Life Insurance or the VA Life Insurance is a bad deal

VA Life Insurance – like every other whole life insurance – aims to combine your death benefit with a savings component. The life insurance industry used to call this an “investment” part. However, the use of the word investment this was rightfully banned by the government. While having a savings component in your VA Life Insurance whole life policy might sound good, it really isn’t since Life Insurance is supposed to be just that – insurance. Here are a few reasons why VA Life Insurance a bad choice compared to a “buy term life insurance and invest the difference” approach:

- High Premiums: Whole life insurance premiums are very high for what they are. And why is that the case? So that the insurance companies can fit in a maximum of fees and skim off profits that your money generates. But not only that, they are also prohibitively expensive for older Veterans. The premiums cap out at a staggering $1,768 per month as of this writing.

- Very Limited Coverage: The maximum coverage offered by VA Life Insurance is $40,000. This might seem like much to some, however, it barely covers the current cost of a funeral and is far off for what a family needs in case there’s a mortgage or you’re trying to fund the education of your children. Compare that to your run of the mill term life insurance that easily offers coverage of up to $3,000,000 for a fraction of the cost.

- Poor Returns: The returns of the money you “invest” with a whole life insurance are not only abysmal compared to normal broad market index or mutual funds – like the S&P500 – that you can buy through any broker or even your Roth IRA or similar, the whole life insurance company is also taking a cut of these returns, leaving you with a measly 1-2% – if that.

- The myth of the “cash value”: You’re probably thinking the cash value that you build up over time goes to your beneficiaries. It does not. Yes, you’ve read that right. The cash value typically does not go to your beneficiaries but to the insurer after your death. Meaning they will only receive the death benefit of your VA Life Insurance policy and that’s it.

- Flexibility: While it sounds great that you’re covered for life with a whole life insurance policy like VA Life Insurance, you’re missing the flexibility term life insurance offers as you can pick specific coverage amounts for periods of “high costs” such as when you still have a mortgage or children to take care of. Also, the investments you build up with the “buy term and invest the difference” are yours to manage. Meaning if you really need to, you can use them for whatever you want.

The “Buy Term and Invest the Difference” Strategy and why it’s better

You might say, but wealthy people get whole life insurance. If they get it, how bad could it be? Well, that’s easy to answer. For those individuals whole life insurance becomes a part of their estate planning. It’s neither meant to secure their income, nor to accrue money. Its sole purpose is to pay less tax on the whole estate. This is only really worth considering when your net worth is north of 8 figures.

Most financial experts and advisors agree that recommending a “buy term and invest the difference” is far superior to buying a whole life insurance like VA Life Insurance for the majority of people and here’s why:

- Lower Premiums: Term life insurance premiums typically cost a fraction of your whole life insurance premium. The average cost of a $500,000 term life insurance at age 30 is roughly $27. Compared to whole life’s $451 premium per month. With VA Life Insurance that same roughly $30 gets you only $20,000 in coverage. Which is really not enough at all.

- Higher Returns: Investing the money, you save on a whole life insurance gives you the opportunity to invest whatever you want. That means, you can take full advantage of tax advantages and put the money into a Roth IRA or similar fund with full control over what you invest in. If you were to say invest into a broad market index fund like VOO that tracks the S&P500 you’d average roughly 10% per year as it has returned 10.26% since it’s inception in 1957 and roughly 11.47% per year in the last 50 years alone.

- No hidden fees: With term life you pay for what you see. There’s no hidden fees or any of that bs.

- Full flexibility: In contrast to VA Life Insurance, you can get however much coverage you want, for however long you want.

- Eliminate the need for insurance: with this approach you come out way ahead of any whole life insurance – completely eliminating the need for any insurance. Yes, even if you don’t collect on the death benefit. If you were to get a $500,000 30-year term life insurance policy and a whole life policy at exactly age 30 and you’d die exactly one day after the term ran out – meaning, there’s no death benefit to collect for your beneficiaries – they’ll get 1. $500,000 from the whole life insurance and 2. $704,982 from your investments (at an average 9% annual return over 30 years).

Why VA Life might still be a consideration and okay choice for some few Veterans

As you’ve maybe known already or just learned, whole life is not a good insurance product. However, VA Life Insurance has its niche cases in where it can be beneficial and that is very sick, rather old Veterans who otherwise do not qualify for any other insurance and/or investment. Ask yourself this question: do you expect to die within less years than it would take you to simply save up however much the death benefit will be. If your answer to this is: yes, then you it might be worth considering VA Life Insurance. However, always keep in mind, that you could also just take that money and put it towards fairly safe investments like treasury bills or simply put it into a HYSA (high yield savings account).

Conclusion

VA Life Insurance can offer coverage to otherwise “uninsurable” Veterans with a service-connection. But it being a whole life insurance makes it very undesirable and an objectively bad choice for most. Limited coverage amounts, high premiums and no flexibility all contribute to that. If you want to secure the future of your family, you’re likely better of with a “buy term and invest the difference” strategy. Especially if you’re younger.

Editor’s Note: We’ve heard from many Veterans who suffer from PTSD who think VA Life Insurance is the only policy they qualify for or that they’re concerned a death caused by a depressive episode could lead to a term life insurance being void. This could not be further from the truth. Most, if not all, term life insurance does cover people who suffer from PTSD, and they do pay out the death benefit to your beneficiaries even in case of a suicide. If you or someone you know suffers from PTSD don’t hesitate to reach out here!

For more information on appropriate term life coverage and investment strategies you can click here and read our article on “how does buy term and invest the difference work exactly”.