Table of Contents

The Veterans’ Group Life Insurance (VGLI) is a life insurance policy offered explicitly to Veterans that allows them to continue with the SGLI coverage after dismissal from the service. This program guarantees that Veterans are insured as long as they continue paying premiums for their policy, unlike the traditional term life insurance with a fixed expiration time. This continuity can be essential for the post-services Veteran who does not qualify for any private insurance policy. However, we should already note that VGLI is not a good life insurance policy in general and most Veterans are far better off cancelling their VGLI policy with the VA if they transferred from SGLI into VGLI and get a private term life insurance policy instead if they’re able to qualify. The same applies if you don’t have a VGLI policy yet. You can skip to here where we explain why VGLI is a bad choice for the majority of Veterans.

The VGLI program provides coverage in increments of $10,000 from $10,000 to $500,000, depending on the veteran’s coverage under SGLI and what plan they chose upon transferring their SGLI into VGLI.

This flexibility enables the Veteran to select the coverage amount that would be more convenient for them financially. One big advantage VGLI has over other life insurance products is that coverage is guaranteed if you apply within 240 days of separation without the need to submit evidence that you’re in good health. The premiums for Veterans’ Group Life Insurance do not vary with the Gender, Health status, or lifestyle of the Veteran, as is the norm with private insurance companies. And no medical exam is necessary which is normal for term life insurances. This element benefits some Veterans because it allows Veterans who could otherwise have problems qualifying with private life insurance due to their health problems to get life insurance quickly. VGLI removes the being in (fairly) good health requirement that could otherwise make it difficult for some Veterans with pre-existing conditions to get life insurance.

VGLI also has other benefits that enhance its feasibility over the different alternatives – at least it appears like that at first glance. For instance, policyholders can increase in $25,000 increments every five years up to $500,000 to allow the policyholders to adjust as they feel fit. This gradual increase can be quite beneficial for Veterans, if they are likely to incur more costs in the future as they age.

VGLI Rates in 2024

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 35.00 |

490,000 | 34.30 |

480,000 | 33.60 |

470,000 | 32.90 |

460,000 | 32.20 |

450,000 | 31.50 |

440,000 | 30.80 |

430,000 | 30.10 |

420,000 | 29.40 |

410,000 | 28.70 |

400,000 | 28.00 |

390,000 | 27.30 |

380,000 | 26.60 |

370,000 | 25.90 |

360,000 | 25.20 |

350,000 | 24.50 |

340,000 | 23.80 |

330,000 | 23.10 |

320,000 | 22.40 |

310,000 | 21.70 |

300,000 | 21.00 |

290,000 | 20.30 |

280,000 | 19.60 |

270,000 | 18.90 |

260,000 | 18.20 |

250,000 | 17.50 |

240,000 | 16.80 |

230,000 | 16.10 |

220,000 | 15.40 |

210,000 | 14.70 |

200,000 | 14.00 |

190,000 | 13.30 |

180,000 | 12.60 |

170,000 | 11.90 |

160,000 | 11.20 |

150,000 | 10.50 |

140,000 | 9.80 |

130,000 | 9.10 |

120,000 | 8.40 |

110,000 | 7.70 |

100,000 | 7.00 |

90,000 | 6.30 |

80,000 | 5.60 |

70,000 | 4.90 |

60,000 | 4.20 |

50,000 | 3.50 |

40,000 | 2.80 |

30,000 | 2.10 |

20,000 | 1.40 |

10,000 | 0.70 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 35.00 |

490,000 | 34.30 |

480,000 | 33.60 |

470,000 | 32.90 |

460,000 | 32.20 |

450,000 | 31.50 |

440,000 | 30.80 |

430,000 | 30.10 |

420,000 | 29.40 |

410,000 | 28.70 |

400,000 | 28.00 |

390,000 | 27.30 |

380,000 | 26.60 |

370,000 | 25.90 |

360,000 | 25.20 |

350,000 | 24.50 |

340,000 | 23.80 |

330,000 | 23.10 |

320,000 | 22.40 |

310,000 | 21.70 |

300,000 | 21.00 |

290,000 | 20.30 |

280,000 | 19.60 |

270,000 | 18.90 |

260,000 | 18.20 |

250,000 | 17.50 |

240,000 | 16.80 |

230,000 | 16.10 |

220,000 | 15.40 |

210,000 | 14.70 |

200,000 | 14.00 |

190,000 | 13.30 |

180,000 | 12.60 |

170,000 | 11.90 |

160,000 | 11.20 |

150,000 | 10.50 |

140,000 | 9.80 |

130,000 | 9.10 |

120,000 | 8.40 |

110,000 | 7.70 |

100,000 | 7.00 |

90,000 | 6.30 |

80,000 | 5.60 |

70,000 | 4.90 |

60,000 | 4.20 |

50,000 | 3.50 |

40,000 | 2.80 |

30,000 | 2.10 |

20,000 | 1.40 |

10,000 | 0.70 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 45.00 |

490,000 | 44.10 |

480,000 | 43.20 |

470,000 | 42.30 |

460,000 | 41.40 |

450,000 | 40.50 |

440,000 | 39.60 |

430,000 | 38.70 |

420,000 | 37.80 |

410,000 | 36.90 |

400,000 | 36.00 |

390,000 | 35.10 |

380,000 | 34.20 |

370,000 | 33.30 |

360,000 | 32.40 |

350,000 | 31.50 |

340,000 | 30.60 |

330,000 | 29.70 |

320,000 | 28.80 |

310,000 | 27.90 |

300,000 | 27.00 |

290,000 | 26.10 |

280,000 | 25.20 |

270,000 | 24.30 |

260,000 | 23.40 |

250,000 | 22.50 |

240,000 | 21.60 |

230,000 | 20.70 |

220,000 | 19.80 |

210,000 | 18.90 |

200,000 | 18.00 |

190,000 | 17.10 |

180,000 | 16.20 |

170,000 | 15.30 |

160,000 | 14.40 |

150,000 | 13.50 |

140,000 | 12.60 |

130,000 | 11.70 |

120,000 | 10.80 |

110,000 | 9.90 |

100,000 | 9.00 |

90,000 | 8.10 |

80,000 | 7.20 |

70,000 | 6.30 |

60,000 | 5.40 |

50,000 | 4.50 |

40,000 | 3.60 |

30,000 | 2.70 |

20,000 | 1.80 |

10,000 | 0.90 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 60.00 |

490,000 | 58.80 |

480,000 | 57.60 |

470,000 | 56.40 |

460,000 | 55.20 |

450,000 | 54.00 |

440,000 | 52.80 |

430,000 | 51.60 |

420,000 | 50.40 |

410,000 | 49.20 |

400,000 | 48.00 |

390,000 | 46.80 |

380,000 | 45.60 |

370,000 | 44.40 |

360,000 | 43.20 |

350,000 | 42.00 |

340,000 | 40.80 |

330,000 | 39.60 |

320,000 | 38.40 |

310,000 | 37.20 |

300,000 | 36.00 |

290,000 | 34.80 |

280,000 | 33.60 |

270,000 | 32.40 |

260,000 | 31.20 |

250,000 | 30.00 |

240,000 | 28.80 |

230,000 | 27.60 |

220,000 | 26.40 |

210,000 | 25.20 |

200,000 | 24.00 |

190,000 | 22.80 |

180,000 | 21.60 |

170,000 | 20.40 |

160,000 | 19.20 |

150,000 | 18.00 |

140,000 | 16.80 |

130,000 | 15.60 |

120,000 | 14.40 |

110,000 | 13.20 |

100,000 | 12.00 |

90,000 | 10.80 |

80,000 | 9.60 |

70,000 | 8.40 |

60,000 | 7.20 |

50,000 | 6.00 |

40,000 | 4.80 |

30,000 | 3.60 |

20,000 | 2.40 |

10,000 | 1.20 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 80.00 |

490,000 | 78.40 |

480,000 | 76.80 |

470,000 | 75.20 |

460,000 | 73.60 |

450,000 | 72.00 |

440,000 | 70.40 |

430,000 | 68.80 |

420,000 | 67.20 |

410,000 | 65.60 |

400,000 | 64.00 |

390,000 | 62.40 |

380,000 | 60.80 |

370,000 | 59.20 |

360,000 | 57.60 |

350,000 | 56.00 |

340,000 | 54.40 |

330,000 | 52.80 |

320,000 | 51.20 |

310,000 | 49.60 |

300,000 | 48.00 |

290,000 | 46.40 |

280,000 | 44.80 |

270,000 | 43.20 |

260,000 | 41.60 |

250,000 | 40.00 |

240,000 | 38.40 |

230,000 | 36.80 |

220,000 | 35.20 |

210,000 | 33.60 |

200,000 | 32.00 |

190,000 | 30.40 |

180,000 | 28.80 |

170,000 | 27.20 |

160,000 | 25.60 |

150,000 | 24.00 |

140,000 | 22.40 |

130,000 | 20.8 |

120,000 | 19.20 |

110,000 | 17.60 |

100,000 | 16.00 |

90,000 | 14.40 |

80,000 | 12.8 |

70,000 | 11.20 |

60,000 | 9.60 |

50,000 | 8.00 |

40,000 | 6.40 |

30,000 | 4.80 |

20,000 | 3.20 |

10,000 | 1.60 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 105.00 |

490,000 | 102.90 |

480,000 | 100.80 |

470,000 | 98.70 |

460,000 | 96.60 |

450,000 | 94.50 |

440,000 | 92.40 |

430,000 | 90.30 |

420,000 | 88.20 |

410,000 | 86.10 |

400,000 | 84.00 |

390,000 | 81.90 |

380,000 | 79.80 |

370,000 | 77.70 |

360,000 | 75.60 |

350,000 | 73.50 |

340,000 | 71.40 |

330,000 | 69.30 |

320,000 | 67.20 |

310,000 | 65.10 |

300,000 | 63.00 |

290,000 | 60.90 |

280,000 | 58.80 |

270,000 | 56.70 |

260,000 | 54.60 |

250,000 | 52.50 |

240,000 | 50.40 |

230,000 | 48.30 |

220,000 | 46.20 |

210,000 | 44.10 |

200,000 | 42.00 |

190,000 | 39.90 |

180,000 | 37.80 |

170,000 | 35.70 |

160,000 | 33.60 |

150,000 | 31.50 |

140,000 | 29.40 |

130,000 | 27.30 |

120,000 | 25.20 |

110,000 | 23.10 |

100,000 | 21.00 |

90,000 | 18.90 |

80,000 | 16.80 |

70,000 | 14.70 |

60,000 | 12.60 |

50,000 | 10.50 |

40,000 | 8.40 |

30,000 | 6.30 |

20,000 | 4.20 |

10,000 | 2.10 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 165.00 |

490,000 | 161.70 |

480,000 | 158.40 |

470,000 | 155.10 |

460,000 | 151.80 |

450,000 | 148.50 |

440,000 | 145.20 |

430,000 | 141.90 |

420,000 | 138.60 |

410,000 | 135.30 |

400,000 | 132.00 |

390,000 | 128.70 |

380,000 | 125.40 |

370,000 | 122.10 |

360,000 | 118.80 |

350,000 | 115.50 |

340,000 | 112.20 |

330,000 | 108.90 |

320,000 | 105.60 |

310,000 | 102.30 |

300,000 | 99.00 |

290,000 | 95.70 |

280,000 | 92.40 |

270,000 | 89.10 |

260,000 | 85.80 |

250,000 | 82.50 |

240,000 | 79.20 |

230,000 | 75.90 |

220,000 | 72.60 |

210,000 | 69.30 |

200,000 | 66.00 |

190,000 | 62.70 |

180,000 | 59.40 |

170,000 | 56.10 |

160,000 | 52.80 |

150,000 | 49.50 |

140,000 | 46.20 |

130,000 | 42.90 |

120,000 | 39.60 |

110,000 | 36.30 |

100,000 | 33.00 |

90,000 | 29.70 |

80,000 | 26.40 |

70,000 | 23.10 |

60,000 | 19.80 |

50,000 | 16.50 |

40,000 | 13.20 |

30,000 | 9.90 |

20,000 | 6.60 |

10,000 | 3.30 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 300.00 |

490,000 | 294.00 |

480,000 | 288.00 |

470,000 | 282.00 |

460,000 | 276.00 |

450,000 | 270.00 |

440,000 | 264.00 |

430,000 | 258.00 |

420,000 | 252.00 |

410,000 | 246.00 |

400,000 | 240.00 |

390,000 | 234.00 |

380,000 | 228.00 |

370,000 | 222.00 |

360,000 | 216.00 |

350,000 | 210.00 |

340,000 | 204.00 |

330,000 | 198.00 |

320,000 | 192.00 |

310,000 | 186.00 |

300,000 | 180.00 |

290,000 | 174.00 |

280,000 | 168.00 |

270,000 | 162.00 |

260,000 | 156.00 |

250,000 | 150.00 |

240,000 | 144.00 |

230,000 | 138.00 |

220,000 | 132.00 |

210,000 | 126.00 |

200,000 | 120.00 |

190,000 | 114.00 |

180,000 | 108.00 |

170,000 | 102.00 |

160,000 | 96.00 |

150,000 | 90.00 |

140,000 | 84.00 |

130,000 | 78.00 |

120,000 | 72.00 |

110,000 | 66.00 |

100,000 | 60.00 |

90,000 | 54.00 |

80,000 | 48.00 |

70,000 | 42.00 |

60,000 | 36.00 |

50,000 | 30.00 |

40,000 | 24.00 |

30,000 | 18.00 |

20,000 | 12.00 |

10,000 | 6.00 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 495.00 |

490,000 | 485.10 |

480,000 | 475.20 |

470,000 | 465.30 |

460,000 | 455.40 |

450,000 | 445.50 |

440,000 | 435.60 |

430,000 | 425.70 |

420,000 | 415.80 |

410,000 | 405.90 |

400,000 | 396.00 |

390,000 | 386.10 |

380,000 | 376.20 |

370,000 | 366.30 |

360,000 | 356.40 |

350,000 | 346.50 |

340,000 | 336.60 |

330,000 | 326.70 |

320,000 | 316.80 |

310,000 | 306.90 |

300,000 | 297.00 |

290,000 | 287.10 |

280,000 | 277.20 |

270,000 | 267.30 |

260,000 | 257.40 |

250,000 | 247.50 |

240,000 | 237.60 |

230,000 | 227.70 |

220,000 | 217.80 |

210,000 | 207.90 |

200,000 | 198.00 |

190,000 | 188.10 |

180,000 | 178.20 |

170,000 | 168.30 |

160,000 | 158.40 |

150,000 | 148.50 |

140,000 | 138.60 |

130,000 | 128.70 |

120,000 | 118.80 |

110,000 | 108.90 |

100,000 | 99.00 |

90,000 | 89.10 |

80,000 | 79.20 |

70,000 | 69.30 |

60,000 | 59.40 |

50,000 | 49.50 |

40,000 | 39.60 |

30,000 | 29.70 |

20,000 | 19.80 |

10,000 | 9.90 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 735.00 |

490,000 | 720.30 |

480,000 | 705.60 |

470,000 | 690.90 |

460,000 | 676.20 |

450,000 | 661.50 |

440,000 | 646.80 |

430,000 | 632.10 |

420,000 | 617.40 |

410,000 | 602.70 |

400,000 | 588.00 |

390,000 | 573.30 |

380,000 | 558.60 |

370,000 | 543.90 |

360,000 | 529.20 |

350,000 | 514.50 |

340,000 | 499.80 |

330,000 | 485.10 |

320,000 | 470.40 |

310,000 | 455.70 |

300,000 | 441.00 |

290,000 | 426.30 |

280,000 | 411.60 |

270,000 | 396.90 |

260,000 | 382.20 |

250,000 | 367.50 |

240,000 | 352.80 |

230,000 | 338.10 |

220,000 | 323.40 |

210,000 | 308.70 |

200,000 | 294.00 |

190,000 | 279.30 |

180,000 | 264.60 |

170,000 | 249.90 |

160,000 | 235.20 |

150,000 | 220.50 |

140,000 | 205.80 |

130,000 | 191.10 |

120,000 | 176.40 |

110,000 | 161.70 |

100,000 | 147.00 |

90,000 | 132.30 |

80,000 | 117.60 |

70,000 | 102.90 |

60,000 | 88.20 |

50,000 | 73.50 |

40,000 | 58.80 |

30,000 | 44.10 |

20,000 | 29.40 |

10,000 | 14.70 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 1,130.00 |

490,000 | 1,107.40 |

480,000 | 1,084.80 |

470,000 | 1,062.20 |

460,000 | 1,039.60 |

450,000 | 1,017.00 |

440,000 | 994.40 |

430,000 | 971.80 |

420,000 | 949.20 |

410,000 | 926.60 |

400,000 | 904.00 |

390,000 | 881.40 |

380,000 | 858.80 |

370,000 | 836.20 |

360,000 | 813.60 |

350,000 | 791.00 |

340,000 | 768.40 |

330,000 | 745.80 |

320,000 | 723.20 |

310,000 | 700.60 |

300,000 | 678.00 |

290,000 | 655.40 |

280,000 | 632.80 |

270,000 | 610.20 |

260,000 | 587.60 |

250,000 | 565.00 |

240,000 | 542.40 |

230,000 | 519.80 |

220,000 | 497.20 |

210,000 | 474.60 |

200,000 | 452.00 |

190,000 | 429.40 |

180,000 | 406.80 |

170,000 | 384.20 |

160,000 | 361.60 |

150,000 | 339.00 |

140,000 | 316.40 |

130,000 | 293.80 |

120,000 | 271.20 |

110,000 | 248.60 |

100,000 | 226.00 |

90,000 | 203.40 |

80,000 | 180.80 |

70,000 | 158.20 |

60,000 | 135.60 |

50,000 | 113.00 |

40,000 | 90.40 |

30,000 | 67.80 |

20,000 | 45.20 |

10,000 | 22.60 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 2,140.00 |

490,000 | 2,097.20 |

480,000 | 2,054.40 |

470,000 | 2,011.60 |

460,000 | 1,968.80 |

450,000 | 1,926.00 |

440,000 | 1,883.20 |

430,000 | 1,840.40 |

420,000 | 1,797.60 |

410,000 | 1,754.80 |

400,000 | 1,712.00 |

390,000 | 1,669.20 |

380,000 | 1,626.40 |

370,000 | 1,583.60 |

360,000 | 1,540.80 |

350,000 | 1,498.00 |

340,000 | 1,455.20 |

330,000 | 1,412.40 |

320,000 | 1,369.60 |

310,000 | 1,326.80 |

300,000 | 1,284.00 |

290,000 | 1,241.20 |

280,000 | 1,198.40 |

270,000 | 1,155.60 |

260,000 | 1,112.80 |

250,000 | 1,070.00 |

240,000 | 1,027.20 |

230,000 | 984.40 |

220,000 | 941.60 |

210,000 | 898.80 |

200,000 | 856.00 |

190,000 | 813.20 |

180,000 | 770.40 |

170,000 | 727.60 |

160,000 | 684.80 |

150,000 | 642.00 |

140,000 | 599.20 |

130,000 | 556.40 |

120,000 | 513.60 |

110,000 | 470.80 |

100,000 | 428.00 |

90,000 | 385.20 |

80,000 | 342.40 |

70,000 | 299.60 |

60,000 | 256.80 |

50,000 | 214.00 |

40,000 | 171.20 |

30,000 | 128.40 |

20,000 | 85.60 |

10,000 | 42.80 |

Coverage amount (in U.S. $) | Monthly premium rate (in U.S. $) |

500,000 | 2,250.00 |

490,000 | 2,205.00 |

480,000 | 2,160.00 |

470,000 | 2,115.00 |

460,000 | 2,070.00 |

450,000 | 2,025.00 |

440,000 | 1,980.00 |

430,000 | 1,935.00 |

420,000 | 1,890.00 |

410,000 | 1,845.00 |

400,000 | 1,800.00 |

390,000 | 1,755.00 |

380,000 | 1,710.00 |

370,000 | 1,665.00 |

360,000 | 1,620.00 |

350,000 | 1,575.00 |

340,000 | 1,530.00 |

330,000 | 1,485.00 |

320,000 | 1,440.00 |

310,000 | 1,395.00 |

300,000 | 1,350.00 |

290,000 | 1,305.00 |

280,000 | 1,260.00 |

270,000 | 1,215.00 |

260,000 | 1,170.00 |

250,000 | 1,125.00 |

240,000 | 1,080.00 |

230,000 | 1,035.00 |

220,000 | 990.00 |

210,000 | 945.00 |

200,000 | 900.00 |

190,000 | 855.00 |

180,000 | 810.00 |

170,000 | 765.00 |

160,000 | 720.00 |

150,000 | 675.00 |

140,000 | 630.00 |

130,000 | 585.00 |

120,000 | 540.00 |

110,000 | 495.00 |

100,000 | 450.00 |

90,000 | 405.00 |

80,000 | 360.00 |

70,000 | 315.00 |

60,000 | 270.00 |

50,000 | 225.00 |

40,000 | 180.00 |

30,000 | 135.00 |

20,000 | 90.00 |

10,000 | 45.00 |

VGLI Eligibility, Application, and SGLI to VGLI Conversion

Eligibility for VGLI

The main factor determining VGLI’s availability is the Veteran being covered by SGLI at the time of the separation from the service. The benefit after which a Veteran is eligible for coverage in total is one year and 120 days from the date of the Veteran’s separation. The eligibility criteria allow those who have worked in different positions within the armed forces to transfer and have continuous life insurance coverage quickly if they do not qualify for private term life insurance policies. The criteria include:

- Release from active duty: This applies to those who have finished their term of service and have been officially released from active duty

- Separation, retirement, or release from assignment in the reserves or National Guard: This category includes the Reserves and National Guard members who have fulfilled their statutory terms of service and the retirees in this service

- Assignment to the Individual Ready Reserves (IRR) or Inactive National Guard (ING): Those Veterans who are in the IRR or ING are still part of the military family but are not on an active-duty status and, therefore, are eligible for Veterans Life Insurance

- Placement on the Temporary Disability Retirement List (TDRL): This also applies to veterans who are put on TDRL because of disabilities incurred while in the service for Veterans Life insurance

These criteria allow many people who have served in the military, almost regardless of the manner of their discharge, to access the program. Generally, your discharge has to be under other than dishonorable conditions (honorable, under honorable conditions, general) to qualify for VA benefits – with includes access to VGLI – however as of June 25, 2024 some Veterans with other than honorable discharges (OTH) may also qualify depending on determination made on a case to case basis by the VA.

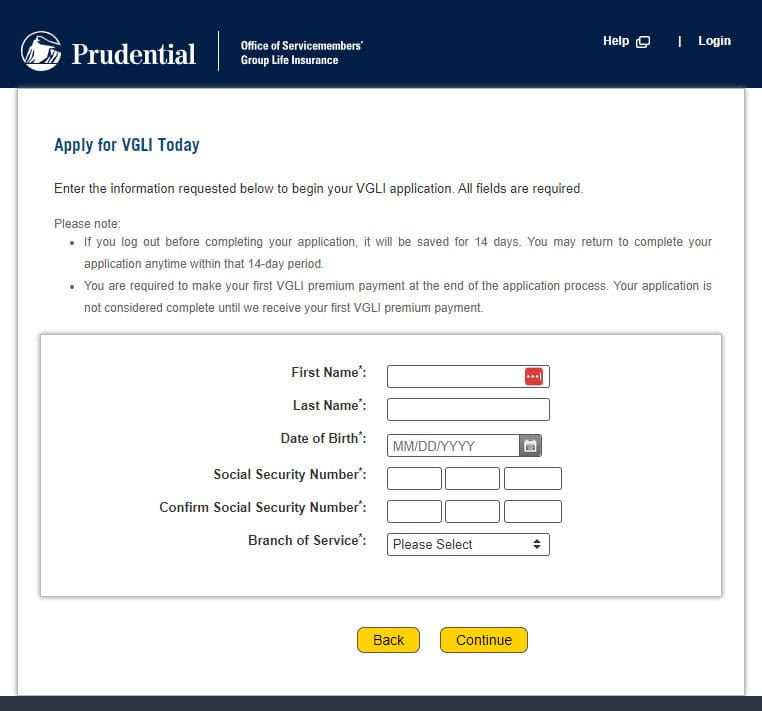

Application Process

VGLI’s application process is simple, so Veterans can quickly get life insurance without facing annoying procedures. They can apply for Veterans Life insurance via the Internet through the OSGLI website or the traditional method by filling out the application form, SGLV 8714.

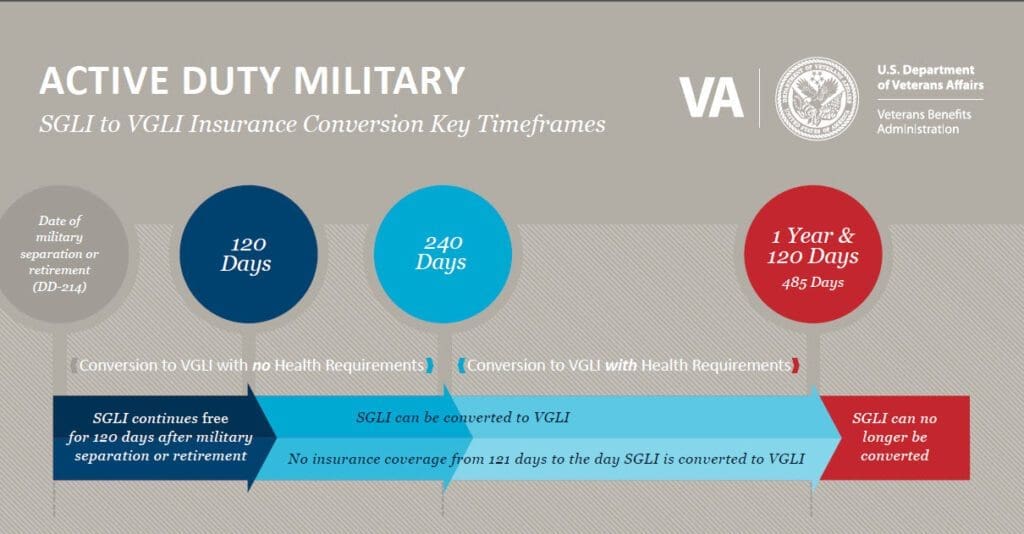

To apply, the Veteran must fill in their personal information, military service information, and the required coverage level. One of the most essential features of the application process is that not only no health exam has to be taken but also no health questions are asked if the application is made within 240 days of separation. This provision helps Veterans with severe pre-existing health conditions to be able to secure life insurance quickly.

However, a health assessment is done for Veterans applying for benefits after 240 days but within 1 year and 120 days. The overall process is surprisingly efficient comparable to most private term life insurance plans. The premiums are payable monthly, quarterly, or annually, where annual premium patients attract specific discounts. This payment option is advantageous and less expensive for Veterans, giving Veterans a 5% discount on their VGLI premium.

SGLI to VGLI Conversion

It was established that the conversion from SGLI to VGLI should be easy and not leave any non-coverage period. To convert, Veterans need not do much; they just have to opt for this option and sustain the coverage they used to have before leaving active duty. This process helps Veterans have life insurance protection regardless of their medical status, which allows them to continue smoothly from military service to civilian life.

Policyholders can raise their coverage every five years by $25,000 up to the maximum coverage of $500,000 until the age of 60 if they chose to do so. This provision enables the Veterans to alter their coverage according to the changes in their budgets and responsibilities at different stages of life. For instance, as the Veterans’ financial needs rise in acquiring a house or taking care of a family, they can easily enhance their life insurance.

Premiums are calculated based on the Veteran’s age without considering factors such as gender, health, or habits. This age-based premium structure is different and may be advantageous for people who might be charged higher premiums or rejected in the open market because of severe health conditions.

Editor’s Note: Contrary to popular belief PTSD is not an automatic disqualification with private term life insurance and generally speaking these policies will pay out the death benefit, even if caused by a suicide. However, there is a 2-year waiting period as to not affect a Veteran’s decision-making when he needs help the most. If you or someone you know is struggling with their mental health, please reach out to get the help and assistance you deserve here!

The coverage is assured to be renewable for life, provided the premium continues to be paid, thus providing lifetime financial protection to Veterans, their surviving spouses, and dependents.

This is Why VGLI is a Bad Choice!

Although there are certain advantages of VGLI, it is not the most suitable for the majority of Veterans, especially if one compares it with a private term life insurance policy combined with a proper investment plan since VGLI acts as a whole life insurance while essentially being a 5-year term life insurance – which is almost always a bad choice. A Veterans life insurance needs are not that different from a civilian in terms of the goal. The life insurance is supposed to protect your “working years” while giving you enough time to build up your own savings and retirement in case something bad happens and you’re not supposed to collect on the death benefit.

This is a very common misconception as the VA does a very bad job at explaining Veterans life insurance to Veterans in our opinion. Both the insurer and the Veteran bet on you outliving the term life policy. You – your beneficiaries – are not supposed to collect on the death benefit. And that is a good thing. Yes, you’ve read that right. You’re not supposed to get the death benefit. This misconception stems from the myth and relentless advertising by insurance companies prior to 2006 that “whole life insurance is an investment” – which it is not, and the insurance industry has since been banned from advertising life insurance as an investment. A Veterans life insurance is one thing and only that: insurance. View it as you would your auto or home insurance. You hope to not get into an accident and the premiums you pay reflect that.

So, what are you supposed to do? Why is there Veterans life insurance? Don’t overthink it. Get a term life insurance policy upon separation, keep it until retirement age and build up your own retirement and investments via a Roth IRA or similar investment on the side. It’ll be worth much more than any death benefit a life insurance policy can provide anyway. Here’s an article on the basics of retirement/investment planning in case you want a quick guide.

And if you need any more reasons to rethink whether you want to get VGLI:

- Cost and Increasing Premiums: One big disadvantage of Veterans Life Insurance is that the policy’s premium rates rise with the policyholder’s age. While the traditional term life insurance offers level premiums for a specific period, for instance, 20 or 30 years, premiums become much higher with VGLI. This can be costly in the long run, especially if the Veteran still holds the policy in their old age as currently VGLI rates cap out at $2,250 per month for a $500,000 death benefit.

- Whole Life Insurance vs. Term Life Insurance: Veterans Life Insurance works on the same principle as whole-life insurance, which provides coverage as long as the premiums are paid. However, as we have explained prior and here whole life insurance is probably the worst insurance product there is for most people. This is why we recommend that most people utilize the “buy term and invest the difference” strategy. It is quite effective because it involves purchasing term life insurance and utilizing the funds that would have been used in acquiring whole life insurance to buy mutual funds, stocks, or bonds without paying absurd fees to insurance companies.

- Limited Coverage Amounts: VGLI coverage is limited to a maximum of $500,000, which might not be enough for the Veterans who are likely to have more financial needs such as large mortgages, children education and other large borrowings. However, the standard term life insurance policies can offer much larger coverage amounts (usually up to $3,000,000) and therefore give more protection to the beneficiaries in case of the insured’s death.

- Sunken cost fallacy: VGLI is acting as a whole life insurance policy, but it really isn’t. And as we have learned, whole life insurances are a bad. You will be tempted to keep VGLI even in the high age brackets even though the premiums become unmanageable at more than $2,000 per month. So you either lower the death benefit or drop out without having anything to show for.

Conclusion

VGLI is an insurance plan that allows Veterans to convert their SGLI into renewable term insurance, meaning the policyholder will be covered as long as he pays premiums. A life-long insurance protection plan for Veterans that covers $10,000 to $400,000. The only real advantage of VGLI is that it does not involve a medical examination and health questions, provided the application is made within 240 days from the date of leaving the service. Providing an option to Veterans with severe health conditions. However, VGLI is acting as a whole life insurance and premiums are charged according to the policyholder’s age, and as a result, the cost of the policy rises dramatically with the policyholder’s age, which becomes prohibitive.

There are plenty of alternatives out there that provide better coverage at a lower cost that cover more Veterans than most think. And this is not only our opinion. Most financial advisors that are worth their salt advise people to purchase a 20–30-year term life insurance policy and use the saved money to pursue better returns. This approach is called “buy term and invest the difference”. This strategy can provide higher returns and more freedom, thus enabling more people to accumulate large amounts of money for their retirement and their loved ones.

Frequently Asked Questions about VGLI

Veterans who had SGLI coverage at the time of separation from service can apply for VGLI.

Veterans who had SGLI coverage at the time of separation from service can apply for VGLI.